The Simple Credit Fix That Can Unlock $50K+ in Funding

(Most People Miss This)

You’ve been told bad credit takes years to fix. That’s a lie.

Learn the same hidden strategies our clients use to boost scores fast and finally break free from high-interest debt.

Fix Your Credit Fast—Without The Guesswork

Your personalized credit plan to remove inquiries, fix reporting errors, and see real score increases—fast.

Book Your Credit Success Call now

Average score boost: 15-30 pts in the first month

One-time fee, no recurring charges

1-on-1 coaching + support

capacity for new clients fILL FAST. Book a strategy call with Michael by clicking below.

📅 Lock In Your Credit Strategy Call

Get a personalized plan to boost your credit score and unlock funding opportunities.

The Difference Between Struggling & Thriving in 2025 Comes Down to ONE Simple Shift…

Stop letting banks control your future. Learn how to fix your credit, unlock $50K+ in funding, and live life on your terms.

What if you could…

✅ Finally getting approved for big credit limits—even if you’ve been told “no” before

✅ Use credit the right way instead of depending on it for everyday bills

✅ Use credit to start or scale your business without touching the money you worked hard to save

💡 This isn’t hype. It’s what happens when you stop letting the banks call the shots and start using the same playbook the top 1% use every day.

A few years ago, I was just like you…

❌ Cards with tiny limits that didn’t help me at all

❌ Getting denied over and over again

❌ Paying interest that felt like it would never end

I did everything I thought was “right.” Paid on time. Stayed out of debt. But no one told me the game was rigged until I learned how it really works.

Fast forward to today…

✅ Over $100K in credit approvals

✅ Business funding without draining my personal savings

✅ Clients going from “denied” to approved in 30-60 days—because they finally have the right plan

we can help!

Our proven system has helped entrepreneurs just like you bypass these obstacles and secure substantial funding—even with credit scores in the 600s.

Does this sound familiar?

You've found the perfect opportunity to grow your business—equipment, inventory, or marketing—but banks keep turning you down because of your personal credit score.

You've tried traditional credit repair, but months have passed with minimal improvement—and every day without funding is another day your competition pulls ahead.

You're stuck using high-interest financing that eats into your profits, or worse—relying on personal savings and credit cards that put your family's financial security at risk.

Don't worry, we can help!

Our proven system has helped entrepreneurs just like you bypass these obstacles and secure substantial funding—even with credit scores in the 600s.

Meet Your SPECIALIST

Hey, I'm Michael — Credit & Funding Strategist!

After struggling with my own credit and nearly losing a vehicle to repossession

I discovered a system that not only fixed my credit but allowed me to build a rental business and invest in real estate—all using strategic credit lines. Now I help entrepreneurs do the same.

Secured over $250,000 in 0% business credit personally

Helped clients collectively unlock $500,000+ in business funding

Specialized in credit optimization for entrepreneurs with scores as low as 550

Featured on 'Art of Being Freed' podcast, 'Neena Perez Straight Talk', and 'Amp'ed Up Live'

Transformed his own credit from poor to excellent, using credit exclusively for investment properties and rental vehicles

TESTIMONIALS

What others are saying

"My life changed forever"

"Michael's team helped me boost my score from 630 to 780 in under 90 days, and I immediately qualified for a $20K credit line at 0%! His system works exactly as promised."- Joan A.

"Highly recommend this"

"Before working with Michael, I had no clue how to structure my business for optimal lending. He literally set up my entire framework and taught me exactly what lenders look for. Now, every time I apply for funding, I'm approved for $25K bank offers—sometimes on the spot!" - John S.

"Highly recommend this"

"Michael's credit repair process was a lifesaver. He got all my negative items removed—including a $27,000 repossession! My score jumped over 100 points, and now I'm well on my way to purchasing my next investment property." - Miles R.

Consistent Success! This Month's Case Study

In Less Than 4 Months:

Closed 38 seat, high ticket

Moving from $175/seat ->

$280/seat & 36 month retention!

Adding $4k per month!

Founder, CEO: Impetra Technology Solutions LLC

- Joe Vitti

IMPORTANT DISCLAIMERS:

All Earnings and income representations are aspirational statements only of your earnings potential. The success of RSC Credit Freedom Solutions LLC, testimonials and other examples used are exceptional, non-typical results and are not intended to be and are not a guarantee that you or others will achieve the same results. Individual results will always vary and yours will depend entirely on your individual capacity, work ethic, business skills and experience, level of motivation, diligence in applying the RSC Credit Freedom Solutions LLC Programs, the economy, the normal and unforeseen risks of doing business, and other factors.

The RSC Credit Freedom Solutions LLC Programs, are not responsible for your actions. You are solely responsible for your own moves and decisions and the evaluation and use of our products and services should be based on your own due diligence. You agree that the

RSC Credit Freedom Solutions LLC Programs are not liable to you in any way for your results in using our products and services. See our Terms of Service for our full disclaimer of liability and other restrictions.

Copyright 2023 © RSC Credit Freedom Solutions LLC | www.rsccredit.com

"I added a FULL Sales System, $1,000 in MRR and $5,000 in projects in the FIRST 3 WEEKS! - You NEED to talk to Chris Wiser about his Inner Circle"

Hallie Talley

Knights of Bytes - Omaha, NE

"In the first 30 days, I added $6,700/Month of new Monthly Recurring Revenue!"

Bill Bunnell

Network Builders - Modesto, CA

"Once I started listening I got to $8,000 MRR in 3 Months"

Bart Barcewicz

BSuite Cyber Security - Chicago, IL

"If you're struggling with sales and marketing, or knowing this is the area you need to make improvements - you need to look at Chris Wiser's coaching"

Jeri Morgan

Code Blue Computing - Denver, CO

"We got THOUSANDS of leads from Chris Wiser's training"

Jason Penka

The TechJunkies - Hays, KS

"Going from ZERO to $4,000 in MRR is HUGE for us!"

Mary Landrum

Nice Guy Technology - Columbus, OH

"I scheduled 4 presentations...out of the 4 I closed 2 on the spot for $108,000 in revenue"

Umut Bitlisli

All Computers Go - Chester, NJ

"If you are feeling like you're STUCK - GET CHRIS WISER'S coaching"

Fred Hughes

Phoenix Technology Solutions - Phoenix, AZ

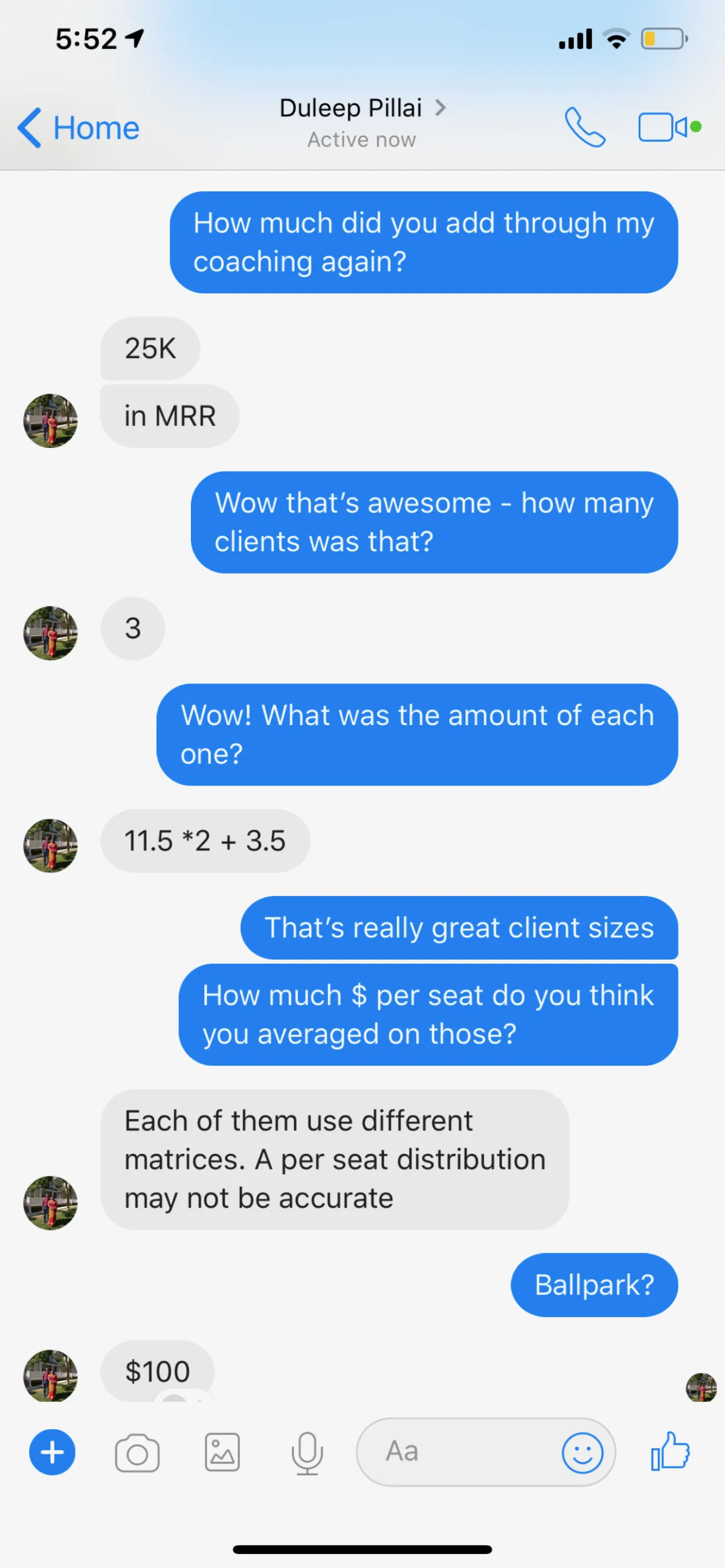

"I added $25,000 in MRR in 3 Months"

Duleep Pillai

Veltec Networks - San Jose, CA